The competitive analysis tools used by our team will yield critical inputs that reveal the strategies of your competitors, as well as the perceived strengths and weaknesses of their brand when pitted against yours. A competitive analysis is a vital part of your marketing plan and evaluates the threats from competitors, while exploring the opportunities they present.

In recent years, competitive intelligence (CI) has attracted the interest of many businesses. This interest is part fueled by easy availability of information and a surge in the proliferation of commercial databases, both free and paid.

Competitive intelligence is a marketing tactic and it is imperative that businesses incorporate it in their strategic marketing plans. It mandates a data gathering system, a process to verify the credibility of data, analysis of data collected, and formulation of action plans based on this information. Online marketers, in this regards, enjoy an advantage over their offline peers; they can get data pertaining to their competitors' marketing activities with much ease as compared to their offline counterparts.

Many organizations use competitive intelligence for counteroffensive when a more productive use would be to utilize it to formulate long term, non-competitive strategies. Applying competitive intelligence to gauge the current and future environment, identifying and neutralizing weaknesses and adapting strategies to the changing environment would bear fruitful results.

Why do some companies in an industry excel and achieve hegemony while others, sometimes with far superior resources, struggle to survive? The answer is simple – they compete with competitive intelligence. I am not trying to imply that other factors won't count, but if all else is equal, competitive intelligence would be the deciding factor.

In the past, gathering, analyzing, and implementing strategies based on metrics of your own website were sufficient to give you a dominant market position. The game plan could very well be formulated in isolation, discounting the external factors. But with the rapid expansion of online commerce, competitive intelligence has gained precedence.

Competitive analysis has two distinct dimensions, the competitors and the criteria, commutatively called the competitive framework. The function of competitive framework is to present data in a fashion that would facilitate the comparison of websites across various criteria, effortlessly. But before you could interpret data you would have to get it, and your competitors are the most unlikely source.

Data acquisition is the most crucial element of competitive intelligence. The Internet serves as a ready source of data, but the level of accuracy varies from one source to another. Absolute facts and figures are hard to come by in most cases.

To give context to the data obtained from aforementioned and other resources, the data will have to be interpreted and represented to provide actionable information. Mentioned below are a few ways in which this could be accomplished.

Conduct Research Professional marketing research, such as focus groups and questionnaires, can provide you with valuable information about your competition.

While a marketing research firm can save you time and legwork, it can be quite expensive and simply not a possibility for new and growing businesses.

Much of the information you need in order to profile your competitors is readily available to all business owners. As your business grows and expands, you should consider supplementing your own research efforts with some formal research conducted for you by an outside firm.

Gather Competitive Information Secondary sources of information are recommended as an excellent starting point for developing a competitive and industry analysis. Secondary sources include information developed for a specific purpose but subsequently made available for public access and thus alternative uses.

For example, books are secondary sources of information as are articles published in journals. Marketing reports offered for sale to the general public also are considered secondary sources. Although, they have been created for a purpose other than your current need, they are still excellent sources of information and data.

With the ever increasing speed of document identification and retrieval through electronic means, secondary sources are not only an inexpensive source of information but are readily available soon after publication.

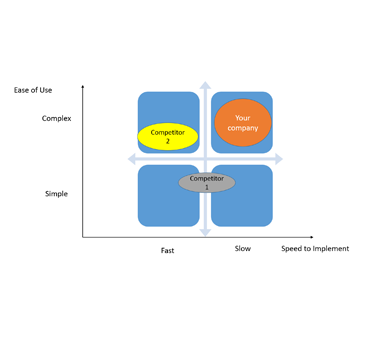

Analyze Competitive Information Once you've gathered all of the competitive data you have been able to locate, it's analysis time. You should analyze to determine product information, market share, marketing strategies, and to identify your competition's strengths and weaknesses.

Product Evaluation You should know from your sales staff and customer feedback what product features and benefits are most important to your customers and potential customers.

A product's or service's competitive position is largely determined by how well it is differentiated from its competition and by its price.

one of several followers, or new to your marketplace. Once you have identified and analyzed your competition, and understand your competitive position, you are ready to do the following: